MODERNIZE YOUR PORTFOLIO

Why private markets?

A portfolio with 60% equities and 40% bonds has long been the easy choice. Historically, it's done well.

But the expected real return of a 60/40 portfolio is only 1.5%. In a yield-starved world, you need a portfolio built for now.

Adding private markets to your portfolio can help boost returns, generate income and diversify from traditional investments.

DIVERSIFICATION

meta-tradesmarket makes it easy to build a diversified investing strategy.

Diversification is one of the most important aspects of investing. Having assets that may perform more independently of each other can help mitigate losses.

Private markets don't often follow the same trends public markets do, and investing in them can help diversify your portfolio without sacrificing performance.

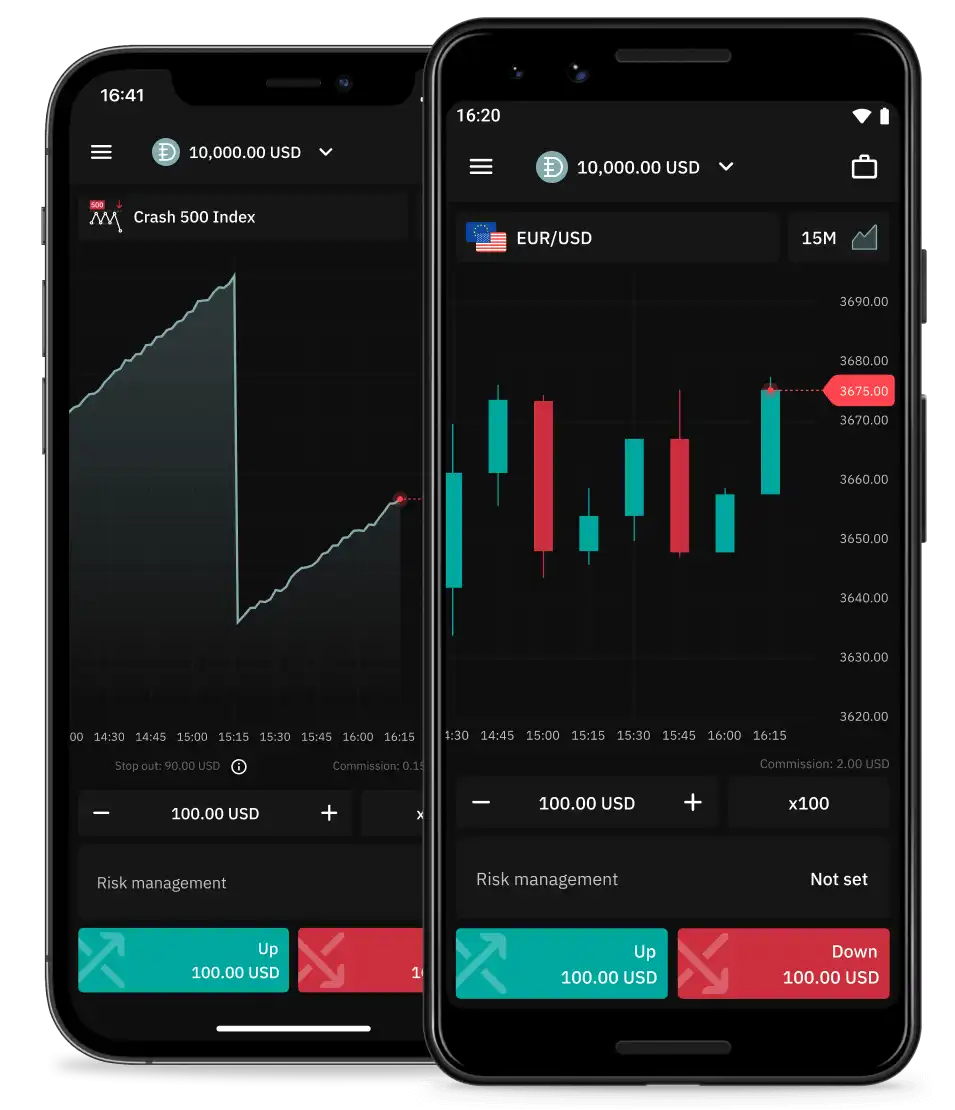

Market Data Analysis

Grab an overview of global markets performance, including change values, Open, High, Low, and Close values for selected financial instruments.

Discover your next great opportunity.

Since 2015, Yieldstreet has transformed private market investing. Discover the potential returns and diversification opportunities you've been searching for — all on one platform.

GOAL-BASED INVESTING

Find investments that align to your financial goals.

Whether you’re looking to generate income, grow your portfolio’s value, or some combination of both, Yieldstreet offers a variety of investment opportunities that can help.

Real Estate

Venture Capital

Private Equity

Private Credit

Art

Short Term Notes

Income Note

Crypto Mining

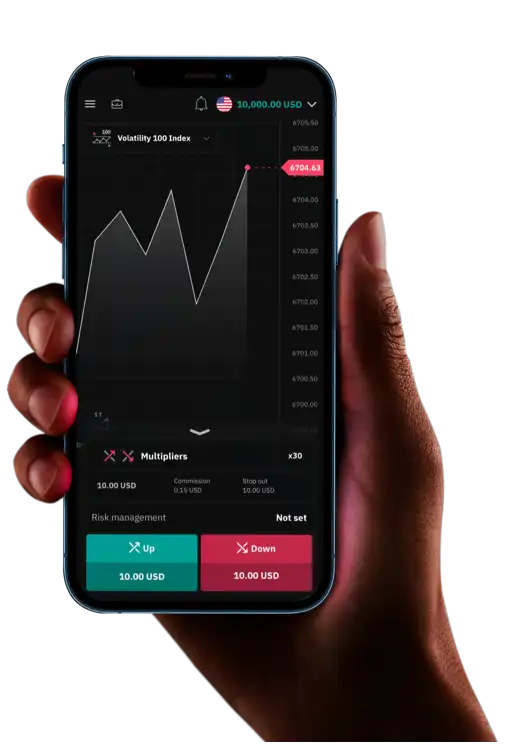

SIMULATOR

See how private markets could work for you using cloud minnings.

Explore our simulator to visualize how sample portfolios could help boost returns and generate income in cloud minning.

TESTIMONIALS

Read what our investors have to say.

Hear it straight from those who have successfully modernized their portfolios with Yieldstreet.

400k+

Registered users

$1.5B

Paid to investors

The testimonials presented on this page have been provided by actual investors in meta-tradesmarket funds without compensation. meta-tradesmarket has selected the testimonials, and certain testimonials have been edited to remove personally identifiable information and for brevity. Testimonials were not selected based on objective or random criteria, but rather were selected based on meta-tradesmarket's understanding of its relationship with the providers of the testimonials. The uncompensated testimonials presented here may not be representative of other investors' experiences, and there can be no guarantee that investors will experience future performance or success consistent with the testimonials presented.

DUE DILIGENCE

Investments reviewed and analyzed by a team of seasoned professionals.

meta-tradesmarket’s investment team partners with industry-leading specialists to assess and provide due diligence for every investment offered.

Join now and start building your modern portfolio.

meta-tradesmarket's simple and easy account setup will have you diversifying your portfolio in just a few clicks.

“meta-tradesmarket offers ordinary investors a seat at the table previously reserved for the ultra-wealthy.”

As of Mar 2022

meta-tradesmarket is ideal for accredited investors with select offerings available to everyone.